12. Thinking About Making a Screw Puzzle Game? Think Again.

Discussion about current state of a Screw Puzzle segment and what these games should do to gain more traction

Thinking about making a Screw Puzzle game (/Nuts & Bolts game)? You should think again! The market may look appealing, but you should rethink.

This article discusses about the current state of a Screw Puzzle segment and what these games should do to start getting more downloads and revenue.

Note: This article has data from AppMagic; Screw Puzzle segment.

Current State of Screw Puzzle Segment

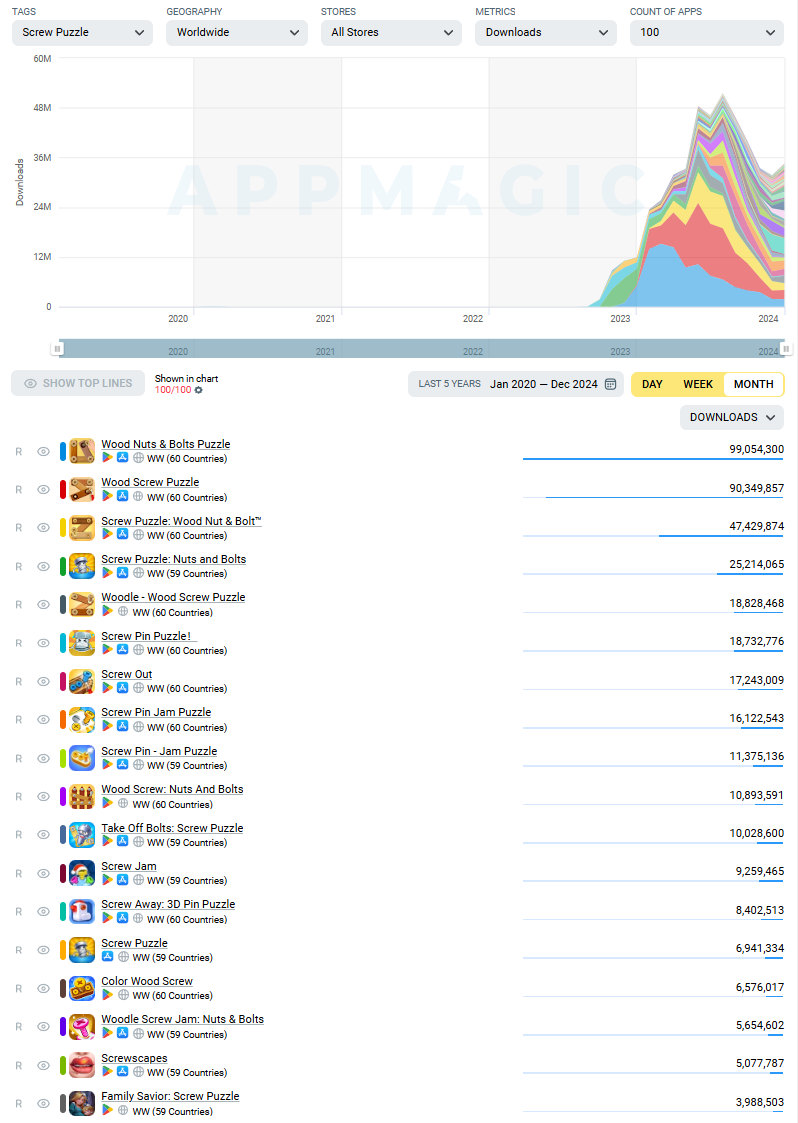

AppMagic paints the picture; the genre has seen its peak, and is now on a downward trajectory.

From Q4 2023 to Jul-Sept. 2024, the market saw fast growth, peaking in downloads and revenue — but, now the story is different:

Downloads

A steep decline, driven by a churning retention profile, rising CPIs due to saturation, and a slowing ROAS profile.

Screw Puzzle segment, Top 100 Downloads (Source: AppMagic).

In terms of downloads, after a big drop, Screw Away: 3D Pin Puzzle boosted some downloads there, towards end of the year, whilst some other games got also more of them. Will this sustain, it’s to be seen. Why to be seen? Let’s discuss about that more below in this article, and how actual growth could be achieved more.

Retention

Significant drops as competitive pressure and squeezed monetization leave players disengaged.

DAUs

DAUs have seen a dip, as retention and monetization strategies falter.

Revenue

Revenue has slowed across the segment as all compounds (from marketing dynamics to engagement design to economy / monetization design).

Screw Puzzle segment, Top 100 Revenue (Source: AppMagic).

Issues with Current Strategies

Whilst the segment has been dominated most by Screw Jam and Wood Nuts & Bolts Puzzle, games such as Wood Screw Puzzle have ridden the wave as follower (/copycat) — and, given this choice, are paying the price for short-term strategies (well, actually I think the whole segment is paying price of what copycats have done for it).

Aggressive Ad Monetization and weak IAPs have led to churning cohorts. The lack of meta and long-term engagement, and short-focused monetization, has squeezed players out — on top of this CPIs have gone up (due to competition, freshness of the gameplay growing old, and overall UA spend); leaving the segment in a churn cycle when followers’ takes on the genre are mostly about copying what’s working and not getting it right. This segment as homogenized its landscape, which is something we need to be aware of tightly, as it can set us up towards a negative cycle when things compound together poorly economy-wise on a segment level. This is what’s happening here — which affects to the whole segment from CPIs to engagement and other metrics.

For these games, a total overhaul is necessary to survive — but there's a catch: rebuilding such a game is more costly and riskier than creating a new game with healthier engagement, a balanced monetization, and a player-first approach.

Why Some Thrive

Take Screw Jam by Rollic — it’s better than others due to balanced UX and focus on engagement and monetization. By making Ads more optional and emphasizing IAPs; it has avoided pitfalls.

Though, even this title is at risk, e.g., without innovations like deeper meta or meaningful features, it too could succumb to competitive pressures.

What Should New Entrants Do?

For bringing fresh ideas to the segment, these directions could be worth:

🔹 Theme-Driven Depth: Exploration and builder metas, offering e.g., meaningful collections and progression.

🔹 Narrative-Meta: Take cues from Gardenscapes and Lily’s Garden. Add narrative-driven meta with personalization elements, creating a world that players can invest in.

🔹 Merge Inspiration: Inspired by e.g., Travel Town and Gossip Harbor, integrate customer-serving core and narrative-building elements to boost engagement. More about Merge Segment by me here (https://gamesalchemy.substack.com/p/the-next-billion-dollar-merge-games):

🔹 Social Mechanics: Clubs, co-op modes, and fully social takes can drive retention and virality; build communities where players stay for their connections as much as the gameplay. Interested about Social mechanics and mechanisms overall — and, maybe you’re open for finding more deeper innovation? See more about what I’ve written these things here (https://gamesalchemy.substack.com/p/8-physiology-and-psychology-how-they):

🔹 Social Casino-Meta: Explore Coin Master and Monopoly Go! inspired social meta, merging casual gameplay with social and competitive elements for engagement loops. With Puzzle in this game’s core, there could be options for blending Attack (Raid) and Super Attack’s around skill-based systems, just as an idea, where shielding (and successfully raiding) something also would be based on skills vs. completely player vs. attacked player approach.

Over time this segment, if it raises its head and developers / publishers are willing to invest in more to it, it goes through the same cycle as other Puzzle segments are going — it’s a thing, kind of, in this industry; from which these predictions are easy to laid out. On top of that, I’m hoping I’ve inspired some readers to look beyond those commercial sentiments and cycles, like pointing my readers to social direction.

Final Words

The segment is no longer easy win!

Rising competition (and CPIs), burned-out cohorts, and squeezed monetization have pushed the market to a breaking point.

It’s time to rethink what Screw Puzzle games can be.